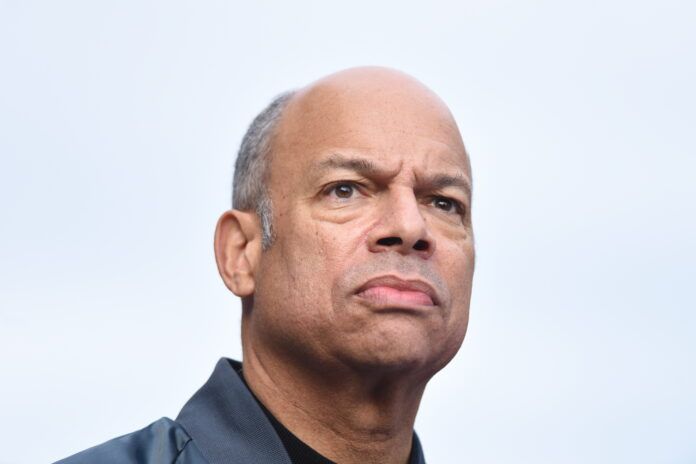

When President Barack Obama asked Jeh Johnson to be the Secretary of the Department of Homeland Security, Johnson wondered why.

“I asked myself, ‘Why is the president asking me to take up the leadership of this very large organization? Am I supposed to emulate Bob Gates, am I supposed to emulate Leon Panetta? Am I supposed to emulate President Obama himself?’ Johnson recalls. “It dawned on me that maybe the president wants me to just simply be the best version of Jeh Johnson, whatever that is. That was the realization I came to: Sometimes we are called upon simply to be the best version of ourselves versus copying the management style of someone else.”

That version of Johnson, who is a director of Lockheed Martin and U.S. Steel, includes asking a lot of questions.

For example, Johnson says, if the CEO does not report on cybersecurity, he will ask about it — at every meeting.

“I think it’s incumbent upon directors to routinely monitor the cybersecurity of their businesses,” Johnson says. “‘Have you had any attacks lately? What was the vulnerability that was exposed? Did you work with law enforcement? Have you read the assessment of the cyber vulnerability of businesses in this particular sector?”

He will also ask management about anything he does not understand, no matter how small.

“It’s about not being afraid to ask the dumb questions, even if you preface it with, ‘I know this is a dumb question,’ because very often, in my experience, three other directors will say, ‘I’m really glad you asked that question because I never understood that either,’” he says.

“You should not be afraid to probe, even if it makes management uncomfortable. I know from experience in a variety of sectors that if directors ask a lot of good questions, it makes management work a little harder. If management comes in, gives a presentation and there’s not a single question about the boring PowerPoint, then management might get a little lazy, get a little sloppy. But if they know they’re going to face tough questions, it makes them work a little harder and makes them think harder about what it is they’re doing day to day.”

Johnson says he values being a leader, whether in the public sector, at his law firm where he mentors younger attorneys or in the boardroom. He has a few leadership tips.

“Don’t just abide by the rules. Values-based judgments are very often as important as abiding by the rules,” he says. “A rule may permit you to do all sorts of things, some of which might be unwise in a particular context, so making values-based judgments to set an example, I think, is important for a leader.

“Never ask a subordinate to do something you wouldn’t do yourself,” he adds, describing a proposal in 2014 to separate undocumented migrants from their children at the border. He says that as a father he couldn’t allow that and he wouldn’t ask anyone else to, either.

“And now the basic golden rule of leadership: Treat others as you would be treated,” he says. “Treat others as you would have them treat yourself or your spouse, your children or your siblings, whether you’re a CEO or a Cabinet secretary, a teacher or a law enforcement official.”