Compensation levels for private company directors are up 25% in 2025, according to the sixth edition of a survey from Private Company Director and Compensation Advisory Partners (CAP). As private company board governance continues to evolve, the complexity and time commitment associated with board service has increased. The additional workload, coupled with greater competition to recruit qualified candidates, has caused private companies to increase pay levels and provide pay structures, such as annual retainers and long-term incentives, that are similar to public companies.

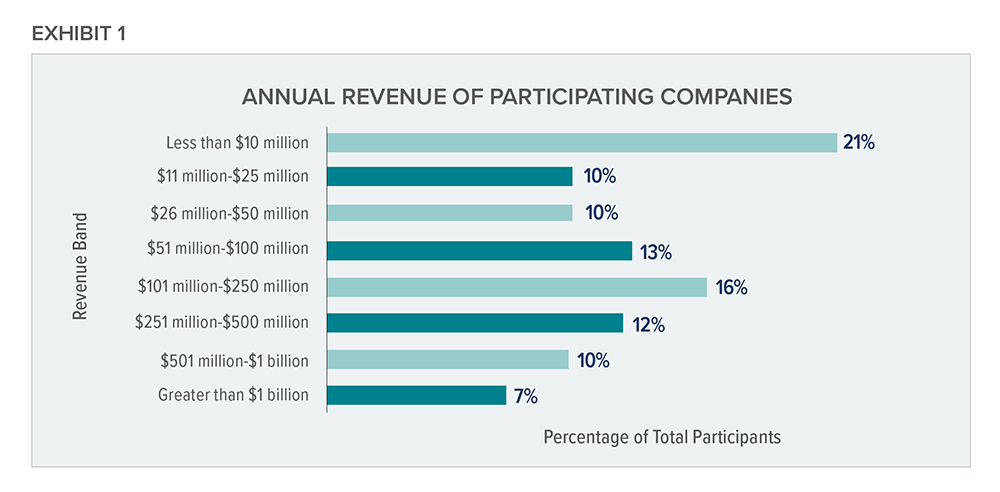

The 2025 Private Company Board Compensation and Governance Survey includes a robust dataset of 633 respondents who certified their data in April 2025 and provides an up-to-date analysis of director pay practices in the current competitive environment. About half of the survey respondents represent family-owned or -controlled companies. Another 17% of respondents represent closely held companies, 18% represent private equity-owned companies and 10% represent companies owned by employee stock ownership plans (ESOPs). The survey respondents span diverse industries and a broad range of revenue sizes, as is shown in Exhibit 1.

Cash compensation levels and practices

Of the survey respondents, 90% provide compensation to directors. The most common forms of compensation and the associated prevalence among survey respondents are:

- Annual cash retainers (77%).

- Meeting fees (38%).

- Incremental compensation for board leadership (40%).

- Incremental compensation for committee leadership (38%).

- Incremental compensation for committee membership (32%).

More than half of companies (54%) use annual retainers as their only form of cash compensation. Twenty-three percent of private companies provide both retainers and meeting fees, and 15% provide only meeting fees, but this number is diminishing each year. Most publicly traded companies provide retainers as their only form of cash compensation. Meeting fees have been eliminated by public companies in favor of retainers, which are simpler and better reflect today’s work formats of ongoing interactions with management. Private companies are following the trend and reducing their use of meeting fees.

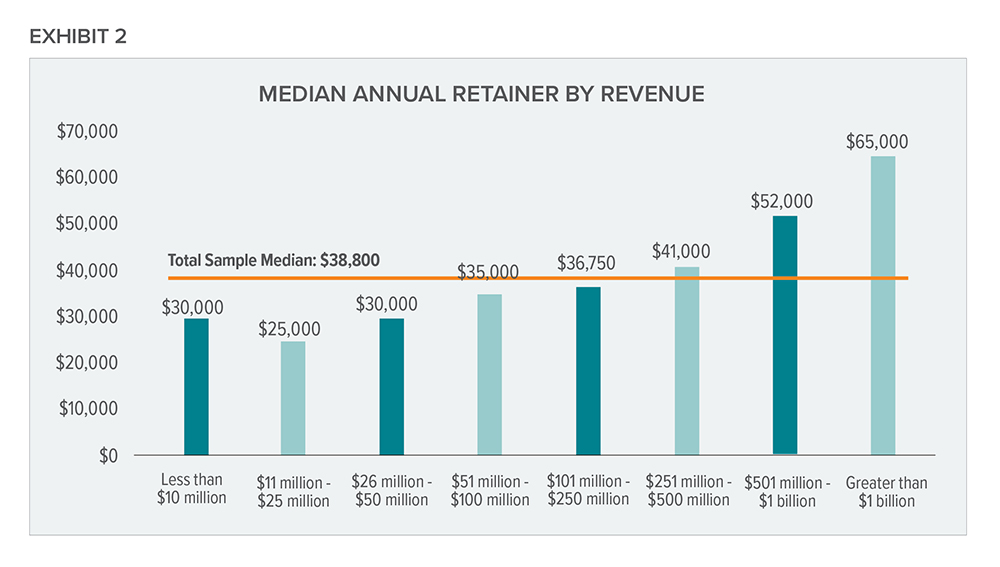

The migration to a cash retainer approach resulted in a 21% increase in median cash retainer amounts this year, while meeting fee amounts remained flat for the fourth year in a row. Annual cash retainers in 2025 are $38,800 at median and $60,000 at 75th percentile for the total survey sample. Many private companies have compensation philosophies that target board and executive pay between the median and 75th percentile (i.e., the third quartile of the market). Higher pay positioning is used to recognize the less frequent use of equity compensation compared to public companies. Equity compensation is highly prevalent and makes up more than half of compensation for public company boards.

As is the case with executive compensation, board retainers for nonemployee directors are highly correlated with company size, as is shown in exhibit 2.

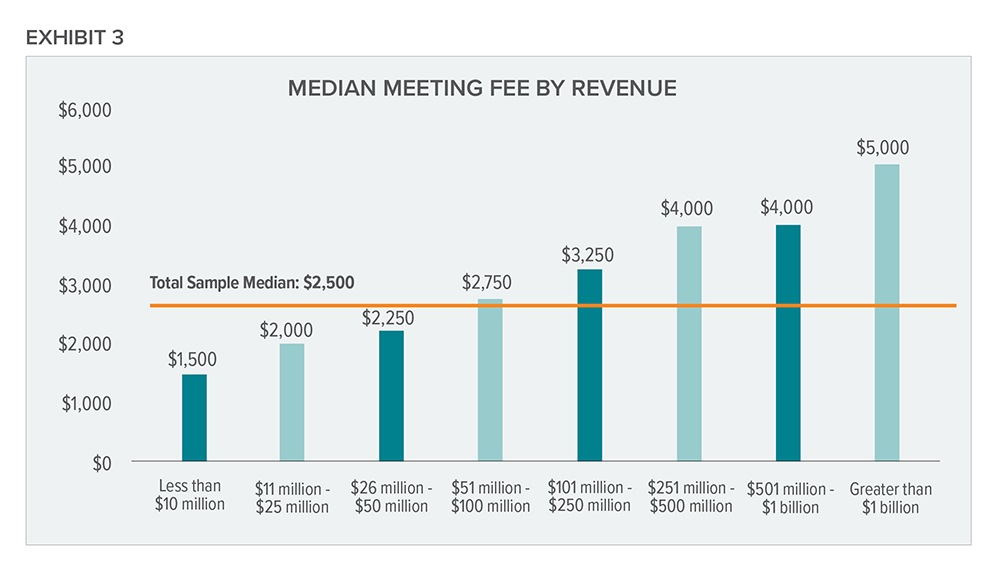

The median meeting fee paid by survey participants remains $2,500, consistent with the last four iterations of the survey. Meeting fees also are correlated with company size, as is shown in exhibit 3.

Long-term incentives

Thirty-seven percent of privately held companies provide long-term incentives (LTI) to directors, up from 28% in 2024. This is a notable increase in the use of performance-based incentives, including cash bonuses and stock grants, for directors at private companies. As private companies compete for directors with specialized skills in a tight talent market, they are adding annual and long-term incentives as part of a competitive board compensation package. Long-term incentives have historically been most common at venture- and private equity-backed companies (74% prevalence), as these companies are incentivizing for a value-realizing event.

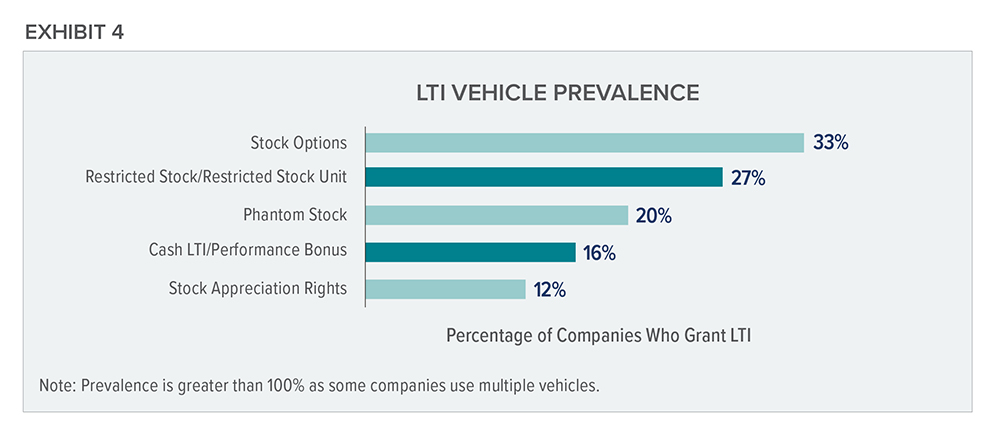

Of the companies that provide long-term incentives to directors, real equity — such as restricted stock or restricted stock units and stock options — is the favored vehicle (see exhibit 4).

Typical practices for private company long-term incentive awards are to grant the awards annually (54%) or when the director is appointed to the board (44%), and awards are typically subject to vesting. Given these two different approaches, grant values vary significantly. The median award value for annual grants is $22,750 for the total survey sample. The median award value increases to $200,000 for front-loaded grants made upon board appointment. The typical vesting period for these front-loaded grants is three or four years (see table 1).

Compensation to family members

Of the respondents, 47% provide compensation to shareholders and family members who serve on the board. The decision to compensate shareholders and family members is a philosophical one. For some companies, the rationale for not paying directors is due to such directors already benefitting from the company through shareholder distributions or employment. Other companies believe in the importance of recognizing contributions, skills and time for all directors, regardless of family or shareholder status. For these companies that compensate shareholders and family members, more than 70% compensate them on the same basis as independent directors.

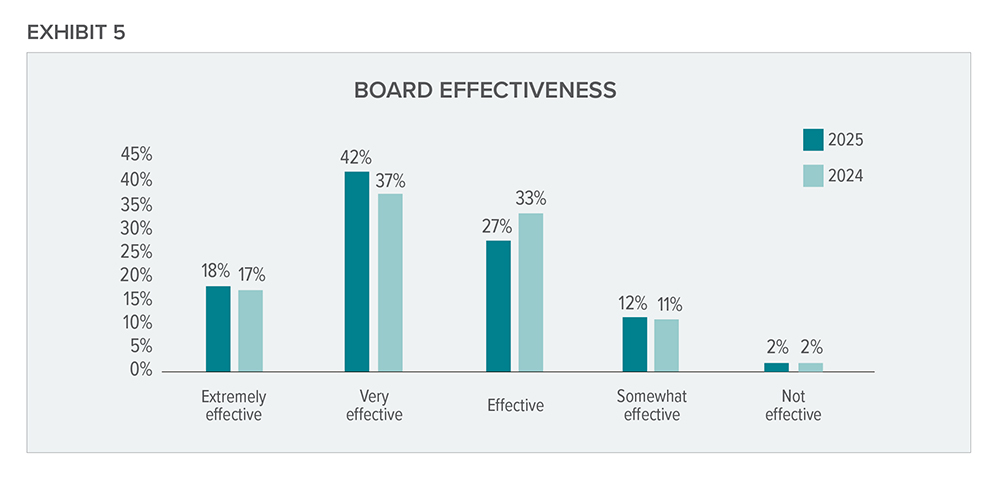

Board effectiveness

The survey asked respondents about the effectiveness of their boards. The respondents overwhelmingly reported their boards are effective, with 87% rating them as effective to extremely effective. This indicates private companies view having a board as a valuable investment (see exhibit 5).

The survey asked about ways to improve board effectiveness and the board’s biggest impacts on the company. The top two ways to enhance board effectiveness are to add board members with specific expertise (e.g., industry, operations, finance) and to increase interactions between management and the board. The biggest impacts of private company boards are serving as a sounding board for management, especially on developing business strategy, and providing enhanced corporate governance.

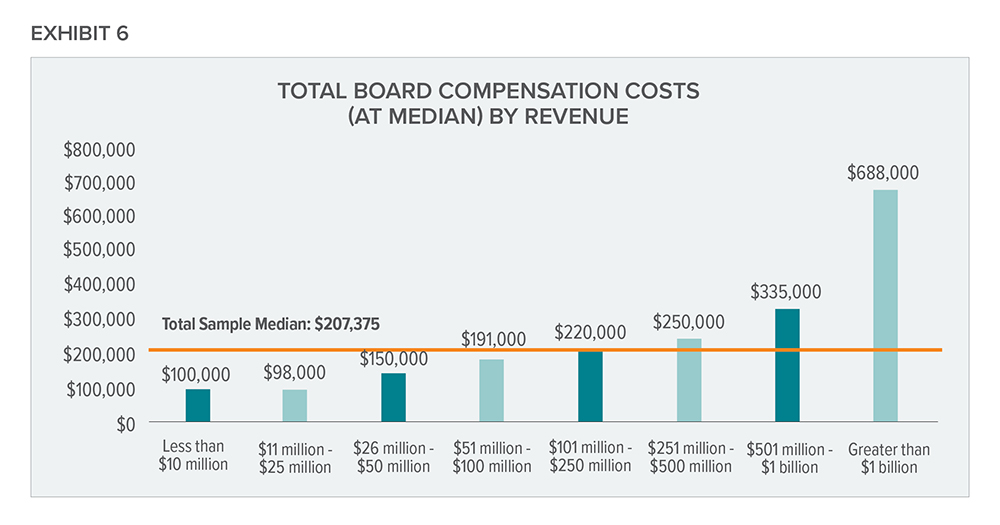

Board costs

To understand the total costs incurred by private companies for having a board, the survey asked participants to calculate the average annual total compensation paid to one director and to all directors on the board. Total compensation includes annual board cash retainers, board meeting fees, short-term and long-term incentives, committee service retainers, meeting fees and leadership premiums for nonemployee directors.

Total board cost is correlated with company size, as is shown in exhibit 6.

This relationship is driven by differences in the amount of compensation given to individual directors, as well as differences in the size of the board. As a company’s revenue increases, the complexity of operations, regulatory requirements and the responsibilities of the board also increase. To deal with this greater responsibility, larger companies may have a larger board and separate committees. Higher compensation is needed to attract qualified talent and reward them for a more considerable time commitment.

Additionally, the survey considers the average annual total board compensation expense as a percentage of revenue across different revenue bands (see exhibit 7).

This statistic can be used for comparisons across companies. It results in an inverse relationship, since costs as a percentage of revenue decrease as revenue increases. Smaller companies have greater governance costs as a percentage of revenue because they need to pay directors at least a certain amount (i.e., opportunity cost) for their time and participation.

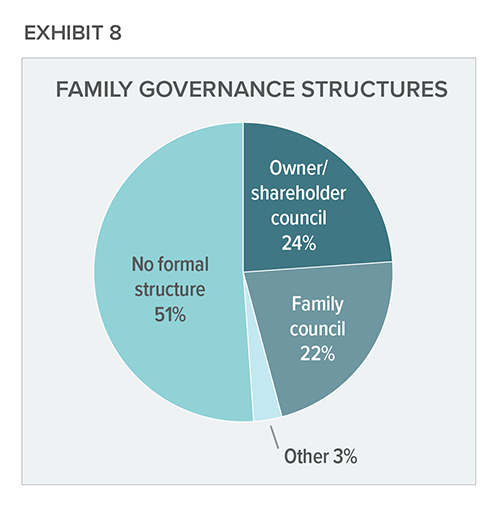

Family and owners councils

For the first time, the 2025 version of the survey gathered data for family and owners councils to better capture the scope of governance forums at family companies (see exhibit 8). Family (or owners) councils are comprised of select members who represent the family (or owners) in matters of importance. Generally, the council is the primary forum for communication and education of the family for the purpose of sustaining engagement in the business. For example, the council may develop education programs on the family’s business, the meaning of shared ownership and proper governance. The family council may also review business financial statements and future investments, the company’s dividend policy, succession planning, family member employment practices, family apprenticeship programs and more.

Among family business respondents to the survey, 46% reported having a formal structure for family governance. Of companies with a family council, 23% pay the leader and 20% pay members. Thirty-six percent of family councils have an established budget.

Looking ahead

Private companies have upped their collective game in director compensation and corporate governance practices this year. As the evolution of private company governance continues, CAP expects further change given the ongoing tight talent market where both public and private companies are competing for the same group of qualified director candidates. The overlap in the market for talent is causing pressure on private companies to increase pay levels and be more creative in their pay structures to support their recruitment efforts.

CAP expects to see continued increases in overall compensation, including annual retainers and average pay per director, given the greater time commitment and expectations placed on board members. Like public companies, private companies will shift over time to the annual retainer model and diminish the use of meeting fees, which create an administrative burden. And CAP expects an increased emphasis on performance-based pay in the form of annual bonuses or long-term incentives (either real stock or cash-based) to align board compensation with shareholder interests and company performance over a director’s tenure.