Board members at privately held and family-owned companies play an important role in governance and oversight and should be appropriately compensated for their contributions and efforts. A question we are asked all the time: What is the appropriate amount of compensation for these board members?

Family Business and Private Company Director magazines and Compensation Advisory Partners (CAP) launched The Private Company Board Compensation and Governance Survey last year. The 2020 iteration drew close to 1,000 responses, representing a broad range of company sizes and industries (see sidebar below). The findings are particularly valuable because private company board compensation data is difficult to obtain.

Annual Retainer

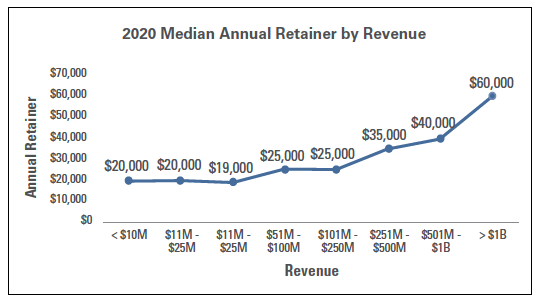

Our survey results show that the typical director at a privately held company is compensated primarily through an annual cash retainer. Of the private companies surveyed, 45% compensate directors through cash retainers only, while another 27% use both retainers and meeting fees. The median amount of the cash retainer is $28,000, a slight decrease from $30,000 in 2019. This $2,000 drop in the overall survey median is the result of increased survey participation from smaller companies rather than changes in the private company board compensation market. Board compensation is highly correlated with company size (see graphic). As a rule of thumb for calculating the competitive range for cash retainers using the median data, retainers can range from one-quarter of median at the low end (10th percentile) to three times the median at the high end (90th percentile).

The Impact of COVID-19

The most common modifications made by private companies are:Approximately 15% of surveyed private companies report that the COVID-19 pandemic drove temporary changes in board compensation. As a comparison, CAP findings show that approximately 20% of the publicly traded companies in the S&P Composite 1500 index modified their director pay programs because of COVID-19.

- Reduction in cash retainers (49% of companies)

- Reduction in meeting fees (23%)

- Elimination of cash retainers (18%)

- Elimination of meeting fees (12%)

The most common duration of these pay modifications is three to six months (30% of companies), followed by the remainder of 2020 (28%) and indefinite/to be determined (27%). The remaining companies report different durations for the pay modifications. Modifications of similar duration have been made to executive pay.

Compensation Beyond Retainers

Not surprisingly, the prevalence of long-term incentives for private company board service is low in comparison to public company board pay practice. About one in four private companies offers long-term incentives for directors, with real equity — stock options or restricted stock/units — being favored. Private companies’ use of long-term incentives in board pay programs indicates that these companies are competing aggressively for board talent and are working to retain board members and align them with the company’s overall success. We expect this trend to continue and to result in increased use of long-term incentives to compensate board members, especially in larger private companies.

Typical long-term incentive practices for private company awards are to grant the awards either annually or when the director is appointed to the board, and to have the awards subject to vesting, typically over three or more years. While grants vary significantly from company to company, the median award is $50,000, which reflects both annual and one-time grants.

Among the other key survey findings:

- More than 51% of the participating companies do not compensate inside directors (defined as family members, executives or shareholders who serve on the board). Most of the companies that compensate inside directors have compensated them on the same basis as the outside directors.

- The most common elements of cash compensation for private company directors are annual retainers (72%), travel reimbursements (68%) and in-person meeting fees (50%).

- Meeting fees continue to be used widely by private companies, while most publicly traded companies have migrated to retainers only. Of the private companies surveyed, 23% use meeting fees as their only form of cash compensation.

- The typical competitive range for in-person meeting fees is $1,000 to $5,000, with $2,500 at median. Telephonic/virtual meeting fees typically range from $500 to $2,000, with $1,000 at median. Meeting fees are higher in 2020 relative to 2019 as a result of COVID-19. With most meetings occurring virtually because of COVID-19, some companies are choosing to pay directors the normal in-person meeting fees, while others are using the lower telephonic/virtual meeting fees. CAP does not expect a decrease in overall compensation for 2020, however, because meetings are often occurring more frequently as companies deal with the impact of the pandemic.

- Thirty percent of companies now pay for telephonic/virtual meeting fees, up from 25% that did so last year. This uptick is likely because of COVID-19 and the inability to meet in person for most of 2020.

- Some private companies provide additional compensation for board leadership roles. The typical incremental retainer is $20,000 for non-employee board chairs, $13,200 for independent lead directors and $5,000 for committee chairs or committee members.

Governance Findings

In addition to benchmarking compensation levels and practices, the survey covers many governance issues, including board size, diversity, independence, workload and committee structure.

The typical private company board ranges from six to 10 directors, with a median of eight directors. This reflects an increase in board size from 2019, when the typical board size was reported as five to eight directors, with a median of seven. The increase in board size over the past year indicates that private company boards have expanded to handle greater workloads or to obtain a broader range of leadership input and skill sets. Survey participants in 2020 report that their boards are about evenly split between inside directors and independent/outside directors, with a slight tendency toward a majority-inside board.

The survey also includes a section on the importance of board diversity and the number of women and minority directors on respondents’ boards. The 2020 survey reports an uptick in private companies indicating that diversity is “very important” or “extremely important.” This trend is expected to continue in the future given the current emphasis on diversity and inclusion. Of the survey respondents, 70% report having one or more women on the board, while 24% report having one or more minority members on the board. Future surveys will demonstrate whether private companies are willing to add diverse members to their boards. The competition for talent could result in an increase in compensation levels to compete with public companies, which are facing mounting public and investor pressure to increase the diversity of their boards.

Other interesting governance findings include:

- Many companies separate the chair and CEO roles. Of the survey respondents, 24% have a board chair who is an outside director, and 22% have a lead independent director. Another 24% report that the board chair is an employee and/or a shareholder (but not the CEO).

- Private company boards typically hold four in-person meetings and two telephonic or virtual meetings in a normal year. During 2020 and COVID-19, that ratio is reversed to four telephonic or virtual meetings and two in-person meetings.

- Three percent of respondents spend 31 to 50 hours on board work, while another 23% spend 51 to 100 hours on board work. Committee work typically adds an additional 10 to 20 hours to annual board work.

- A small minority of private companies have term limits for directors, and an even smaller number of private companies have a mandatory retirement age. Practices vary for term limits, with one- to three-year term limits being the most common. The most prevalent mandatory retirement age range is 71 to 75 years old. ■

| About the Survey Participants The 980 respondents to the 2020 Private Company Board Compensation and Governance Survey — conducted by Compensation Advisory Partners and Family Business and Private Company Director magazines — represent a broad range of industries and revenue sizes. Manufacturing was the most represented industry (28% of respondents), followed by finance and insurance (10%); professional, scientific and technical services (9%); retail trade (7%); wholesale trade (7%); construction (6%); and real estate, rental and leasing (6%). (Additional industries are represented in the survey; only those with representation of 6% or more are listed above.) Participating companies varied widely in size as measured by revenue, number of employees and assets (financial services and insurance companies only). As shown in the chart below, respondents’ companies generated annual revenues from less than. $10 million to more than $1 billion. Most participants were based in the United States, but the survey drew responses from all over the world. Nearly two-thirds of the respondents had fiduciary boards, while the remainder had advisory boards. The majority (59%) of participating companies were totally family-owned, while 15% were majority family-owned or family-controlled, 12% were closely held by unrelated owners, 7% were private equity-owned, and 4% were owned by employee stock ownership plans (ESOP). Among the business structures represented were S corporations (39.6% of respondents); C corporations (29%); limited liability companies, or LLCs (16%); and partnerships (3.6%). Additional ownership categories and business structures are represented in the survey and are covered in the full survey report. |

Bonnie Schindler is a principal with Compensation Advisory Partners.