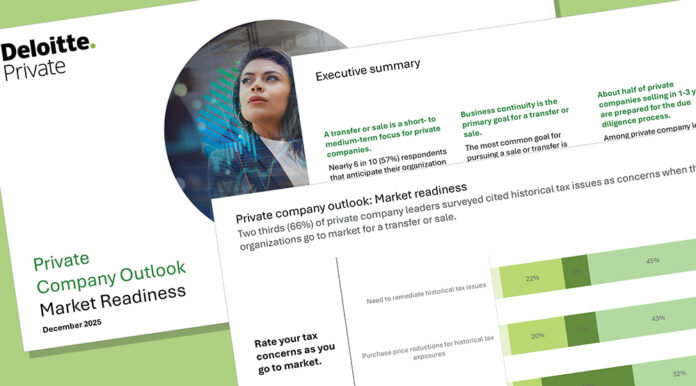

Deloitte Private recently asked leaders of 100 private companies planning a future transfer or sale about their organization’s timing, readiness, goals and preparation for a transaction. The survey, titled “Private Company Outlook: Market Readiness,” gauged private company leaders’ perspectives on opportunities and risks to business, both now and in the future. Among several findings, the survey revealed that 57% of respondents from organizations planning a future transfer or sale anticipate their company will engage in a transaction in the next one to three years. Business continuity (40%) is cited as the dominant driver for pursuing a sale or transfer, outpacing liquidity for the business (22%) or for business owners (13%). Those seeking to sell all or part of the organization are motivated by scaling for growth via partnerships (45%) or financial sponsors who can support future expansion (37%). We spoke with Wolfe Tone, U.S. Deloitte Private leader, for insights into the survey’s findings.

Private Company Director: Given respondents were nearly split between market conditions and internal readiness as the primary drivers of transaction timing, what should boards be doing now to ensure the organization is genuinely prepared for due diligence and not overly reactive to external conditions?

Wolfe Tone: It’s a really complicated question in some ways, and, in other ways, it’s a really simple question. When you look at an organization that is thinking about a transaction, and the survey only looked at organizations that were somewhere on the cusp of selling in the next five-plus years, the reality is that boards play a critical role in this process. And it’s beyond valuation, it’s beyond market conditions — it’s the compilation of the readiness of the organization from a diligence perspective. It’s a readiness from the owners and the stakeholders to make that mental leap of having an outside party suddenly become engaged with the organization and partnering with them going forward. It’s the preparation for diligence efforts to identify where there are gaps in that company and asking if there are mitigation efforts to either eliminate or fill those gaps. There is the anticipation of the timing elements, and this is something I see oftentimes with organizations: they get excited about a transaction, but the reality is that it takes a lot of time, effort and focus away from running the business. I think a board plays a critical role in making sure the executives continue to run the organization as necessary to achieve the business’s operational aspirations, but also have the capabilities and the bandwidth to do a sales process. Part of that is also ensuring that they’ve got the right level of support, whether that’s internal or external. Do they have the right team engaged if necessary? Do you have the right outside advisors, accountants and attorneys? On the valuation front, I think valuations are great. They’re necessary in so many aspects of a deal. They set forth the basics of estate planning and succession. They allow for compensation planning on a going-forward basis. They establish market value. It gives an indication of what the market may be. But we all know that true fair market value is when a willing buyer meets a willing seller and they agree on a fine price. And you don’t really get that until you have a true transaction in place. And then try to time that relative to markets. Timing markets is difficult. Just look at 2025: You see higher valuations, an increase in valuations and higher by-deal volume. In 2026, the winds are prevailing and you can see more robust M&A activity into the new year, given reducing interest rates, particularly in certain sectors and businesses, technologies and supply chains. All of those seem to be capturing more attention than others.

PCD: The survey shows that many companies planning a sale within five years have obtained valuations but are still underprepared for due diligence. What governance red flags should directors look for to assess whether management is realistically ready to engage third-party advisors and withstand buyer scrutiny?

WT: When I think about the clients that I’ve served and the transactions I’ve been a part of, what I see is, while organizations may be mentally prepared, what they don’t have visibility toward, particularly at a board level, is where the gaps are. If you think from a due-diligence perspective, a lot of information is shared — very private information from an accounting and operational tax perspective. Using taxation as an example, the potential to have a tax issue arise during diligence is far beyond just federal income tax. It’s state income tax. It’s indirect taxes. You’d be surprised at how many transactions actually fall apart as a result of what some people consider as ancillary taxes or sales tax vs. federal tax. Tax law continues to become more complex at all three of those levels, as well as internationally. If I’m a board, I would look closely at key areas of diligence like operations, accounting, HR, and tax. What we’re seeing is that more companies over time are taking steps ahead of a transaction, calling it pre-transaction diligence, and effectively doing diligence on themselves to ascertain whether they are ready to go through third-party diligence. It may also start to identify potential gaps and help boards determine if the right individuals are in place to get through a transaction with as little pain as possible.

PCD: With tax concerns topping the list — recognized gains, transfer taxes and historical tax issues — how should boards integrate tax-risk assessment and tax-advantaged planning (such as leveraging losses or opportunity zones) into their oversight of a potential transaction?

WT: What I see boards and organizations doing pre-transaction is starting to model. Boards need to understand what the economics are. What are the after-tax profits and proceeds of a transaction? And that’s taking into consideration any tax assets. That could be net operating loss carry-forwards, passive loss carry-forwards or utilization deferral mechanisms like the opportunity work zone — putting this all into models and start thinking it through. And these models should have the flexibility to run different transaction sizes and start to look at what the after-tax proceeds will be. People get excited about top-line numbers and initial proceeds. But, ultimately, it’s after-tax proceeds that are the key measurement, and you can’t get into that level of analysis without doing some fairly complex modeling efforts.

PCD: The expectations for cash-plus-earnout structures and the differing views between large and smaller companies raise alignment questions. What role should boards play in ensuring that sale-proceed structures fairly balance management incentives, shareholder expectations and long-term enterprise value?

WT: The concept of earnouts is not new, but you can certainly see the dichotomy between larger organizations and smaller organizations on the expectations of earnouts. I think that really speaks to the complexity of these businesses. The smaller the business and the less risk there is for a buyer, the less need there is to have a management team or a founder or some of the executives staying on. Conversely, the larger the transaction, the more those buyers want skin in the game. They want the sellers to be a part of the business and to be part of the transition. So, if I’m a board, I am looking at what value does that earnout provide to the buyer? Why would they want it? What is the expectation or reality of both receiving that earnout and in totality, and what’s the risk of not receiving that, and advising the owners and the executives of the potential risks of not meeting those expectations.